-

Ethereum vs Solana: Key Differences, Similarities, and Comparative Advantages

Introduction

As blockchain technology continues to revolutionize the digital landscape, two of the most prominent platforms—Ethereum and Solana—stand out for their innovation and impact. Both networks provide the infrastructure necessary to develop decentralized applications (dApps), host smart contracts, and facilitate decentralized finance (DeFi). However, they differ significantly in architecture, scalability, consensus mechanisms, and user adoption. This article delves into the key differences and similarities between Ethereum and Solana and highlights the unique advantages each platform holds over the other.

Ethereum Overview

Launched in 2015 by Vitalik Buterin and others, Ethereum was the first blockchain to introduce smart contracts and a programmable infrastructure. Ethereum’s ecosystem has since grown exponentially, becoming the most widely used blockchain for dApps, DeFi, and non-fungible tokens (NFTs).

Solana Overview

Solana, launched in 2020 by Anatoly Yakovenko, offers a high-performance blockchain platform designed for scalability and low transaction costs. It introduced a unique hybrid consensus model combining Proof of History (PoH) and Proof of Stake (PoS), enabling extremely high throughput and efficiency.

Key Differences Between Ethereum and Solana

Consensus Mechanism

Ethereum: Initially used Proof of Work (PoW) but transitioned to Proof of Stake (PoS) with the Ethereum 2.0 upgrade (The Merge) in September 2022. This shift improved energy efficiency and transaction speed.

Solana: Employs a hybrid model of Proof of History (PoH) and Proof of Stake (PoS), allowing validators to timestamp transactions and achieve high throughput with low latency.

Transaction Speed and Throughput

Ethereum: Handles roughly 30 transactions per second (TPS) on its mainnet. Scalability solutions like Layer 2 rollups (e.g., Arbitrum, Optimism) help improve throughput.

Solana: Capable of processing up to 65,000 TPS, making it one of the fastest blockchains available. Its architecture is designed to scale with hardware advancements.

Transaction Fees

Ethereum: Known for high gas fees, especially during periods of network congestion. These fees vary depending on transaction complexity and network demand.

Solana: Offers consistently low transaction fees, often less than a penny, making it more accessible for micro-transactions and frequent use.

Development Ecosystem

Ethereum: Boasts the largest and most mature developer ecosystem. It uses Solidity as its primary programming language and has extensive documentation, tooling, and community support.

Solana: Utilizes Rust, C, and C++ for development. While newer and smaller in scale, Solana’s ecosystem is rapidly growing, especially in areas like NFTs and DeFi.

Network Stability and Downtime

Ethereum: Known for its stability and resilience. While it has faced scalability issues, it rarely experiences significant downtime.

Solana: Has experienced several network outages due to issues like congestion and bugs in the validator software. These incidents have raised concerns about its long-term reliability.

Decentralization

Ethereum: Maintains a high degree of decentralization, with thousands of nodes distributed globally.

Solana: While efficient, it has faced criticism for being more centralized, partly due to the high hardware requirements for running validator nodes.

Key Similarities Between Ethereum and Solana

Smart Contract Support

Both platforms allow developers to create and deploy smart contracts, enabling decentralized applications across industries like finance, gaming, and real estate.DeFi and NFT Ecosystem

Ethereum and Solana host a wide range of DeFi platforms and NFT marketplaces. While Ethereum remains the leader in total value locked (TVL), Solana is catching up with innovative projects and lower entry costs.Token Standards

Each platform has established token standards to ensure interoperability:Ethereum: ERC-20 (fungible tokens) and ERC-721/ERC-1155 (NFTs)

Solana: SPL tokens

Open-Source Philosophy

Both blockchains are open-source, allowing developers to build on and contribute to the network’s codebase.

Advantages of Ethereum Over Solana

Network Maturity

Ethereum has been operational since 2015, giving it a time-tested infrastructure and more established user trust.Developer Ecosystem

With a vast developer base and numerous educational resources, Ethereum offers better support for newcomers and advanced developers alike.Security and Auditing Tools

Ethereum benefits from a wide range of security tools, audit services, and battle-tested protocols.Interoperability and Integration

Ethereum enjoys broader adoption and integration with other blockchain solutions, wallets, and exchanges.

Advantages of Solana Over Ethereum

Speed and Scalability

Solana’s architecture supports much higher transaction throughput, making it ideal for applications requiring real-time interactions.Low Transaction Costs

Its minimal transaction fees make it accessible for a broader audience, especially for applications involving micro-transactions.Innovative Consensus Mechanism

The integration of Proof of History gives Solana a unique edge in synchronizing time across nodes, which significantly enhances throughput.Growing Ecosystem with Strong Backing

Solana’s ecosystem is rapidly expanding, supported by major partnerships and developer grants that foster innovation.Conclusion

Ethereum and Solana each bring unique strengths to the blockchain ecosystem. Ethereum offers unmatched security, decentralization, and a mature ecosystem, making it a robust choice for developers and enterprises seeking reliability. Solana, on the other hand, provides unparalleled speed and cost-efficiency, making it attractive for applications requiring high performance.

The choice between Ethereum and Solana ultimately depends on the specific needs of a project. Developers prioritizing decentralization and community may lean toward Ethereum, while those focused on scalability and performance might prefer Solana. As both platforms continue to evolve, their complementary strengths are likely to shape the future of decentralized technology.

-

The Future of Solana (SOL): What Lies Ahead for This High-Speed Blockchain?

Solana (SOL) has emerged as one of the most prominent blockchain platforms in the cryptocurrency industry. Known for its exceptional transaction speeds and low fees, Solana has built a strong reputation as a viable alternative to older blockchains like Ethereum. But as we look ahead, critical questions remain: What is the future of Solana? Can it maintain its growth? And how will upcoming technological advancements and market trends shape its trajectory?

In this article, we’ll dive deep into Solana’s potential, challenges, and innovations, offering a comprehensive outlook on what’s next for the SOL ecosystem.

What Makes Solana Stand Out?

Before discussing the future, it’s important to understand why Solana became a major player in the first place.

- Unmatched Speed and Scalability:

Solana uses a unique consensus mechanism called Proof of History (PoH), which timestamps transactions before they are confirmed by the network. This innovation allows Solana to process over 65,000 transactions per second (TPS), far outpacing Ethereum’s 15-30 TPS. - Low Transaction Costs:

While Ethereum gas fees can reach tens or even hundreds of dollars during periods of congestion, Solana transactions typically cost fractions of a cent. This makes it attractive for developers and users alike. - Vibrant Developer Ecosystem:

Thousands of projects, including DeFi platforms, NFT marketplaces, and Web3 applications, have been built on Solana. The ecosystem continues to grow rapidly, supported by strong venture capital interest and active community engagement.

The Current State of Solana (As of 2025)

After facing challenges like the FTX collapse in 2022—which heavily impacted Solana due to its close ties with the exchange—the network has shown remarkable resilience.

Recent milestones include:

- Launch of Solana Mobile (Saga Phone) promoting native dApps.

- Firedancer, a new validator client developed by Jump Crypto, promising even higher network reliability and throughput.

- Growth of NFT and DeFi sectors on Solana despite broader market downturns.

- Strategic partnerships with major brands and tech companies.

All these developments position Solana not just as a blockchain solution, but as a technology platform for the decentralized future.

Key Trends Shaping Solana’s Future

1. Mass Adoption of Web3 and dApps

The success of Solana’s mobile initiative shows a commitment to bringing blockchain technology to the mainstream. With smartphones integrated directly into the Solana blockchain, users can interact with decentralized apps (dApps) seamlessly. As user experience improves, mass adoption of Web3 is likely to accelerate—and Solana aims to be at the forefront of this movement.

Expect to see Solana:

- Powering next-generation social media apps.

- Becoming a hub for decentralized finance.

- Hosting gaming platforms and metaverse projects.

2. Technological Upgrades

The upcoming Firedancer upgrade is set to revolutionize Solana’s performance. Firedancer will introduce a highly optimized validator client capable of scaling the network to over 1 million TPS. If successful, this could establish Solana as the most scalable blockchain globally.

Moreover, continuous improvements to network security, developer tools, and ecosystem interoperability will be critical to maintaining competitive advantage.

3. Expansion into Real-World Applications

Solana is positioning itself beyond the crypto industry into areas like:

- Supply chain management

- Healthcare

- Identity verification

- Real estate tokenization

Real-world asset (RWA) tokenization is a growing trend, and Solana’s speed and low costs make it a natural platform for these innovations.

4. Sustainability Initiatives

Environmental concerns have plagued proof-of-work blockchains like Bitcoin. Solana, by contrast, already operates as a carbon-neutral blockchain. Expect sustainability to remain a key marketing and strategic pillar, especially as governments and corporations look for eco-friendly blockchain solutions.

Potential Challenges Ahead

While the future looks promising, Solana is not without its challenges:

1. Network Outages

One of the biggest criticisms against Solana has been its occasional network downtimes. Although upgrades like Firedancer aim to address this, reliability remains crucial for attracting enterprise-grade applications.

2. Competition from Layer-2 Solutions

Ethereum’s growing ecosystem of Layer-2 solutions (such as Arbitrum, Optimism, and zkSync) offer scalability improvements without moving away from Ethereum’s large user base. Solana must continue to differentiate itself and build unique network effects.

3. Regulatory Uncertainty

Global regulatory frameworks for cryptocurrencies are still evolving. How Solana and its associated projects navigate these legal landscapes—especially concerning securities laws—could impact growth potential.

Solana Price Prediction: Where Will SOL Go?

Price forecasting is notoriously tricky, but based on current trends, a few potential scenarios emerge:

- Bullish Scenario:

If Solana successfully scales to millions of TPS, achieves greater enterprise adoption, and overcomes reliability issues, SOL could re-enter the top 3 cryptocurrencies by market cap, potentially reaching prices north of $500-$1000 by 2030. - Neutral Scenario:

If growth continues at a steady but slower pace, SOL could maintain a strong position in the top 10 cryptocurrencies, trading in the $150-$300 range in the medium term. - Bearish Scenario:

Failure to address technical challenges or major regulatory clampdowns could suppress prices, potentially falling below $50 over time.

Of course, broader macroeconomic conditions, Bitcoin’s price action, and market sentiment will also heavily influence SOL’s future price.

Final Thoughts: Is Solana the Blockchain of the Future?

Solana has already proven itself as a high-performance blockchain capable of supporting a wide array of applications. Its ability to adapt, innovate, and expand into new sectors will be key to determining its long-term relevance.

If Solana can continue to deliver on its promises—enhancing reliability, scaling massively, and driving real-world adoption—it has the potential to not just survive, but lead the next generation of blockchain technology.

In short:

✅ Outstanding technology

✅ Strong ecosystem growth

✅ Clear roadmap for scalability

✅ Focus on sustainabilityWhile risks remain, the future of Solana looks bright and full of promise for investors, developers, and users alike.

- Unmatched Speed and Scalability:

-

The Future of the Crypto Industry: A Deep Dive into What Lies Ahead for Bitcoin

The cryptocurrency industry has come a long way since Bitcoin’s inception in 2009. From being dismissed as a niche tool for tech enthusiasts to becoming a global financial phenomenon, crypto has fundamentally altered how we view money, decentralization, and digital ownership. While thousands of cryptocurrencies now exist, Bitcoin remains the most recognized and influential player. As we look toward the future of the crypto industry, Bitcoin’s role will be pivotal. But what does that future look like?

Bitcoin: The Origin and the Foundation

Bitcoin, created by the pseudonymous Satoshi Nakamoto, was born out of the 2008 financial crisis. Its vision was clear: a decentralized currency that operated independently of traditional financial systems, providing users with more control and transparency. Over the years, Bitcoin has transitioned from being a purely transactional currency to a store of value often dubbed “digital gold.”

As of 2025, Bitcoin has faced many highs and lows—from record-breaking bull runs to harsh regulatory crackdowns. Despite volatility, its adoption continues to grow, not just by retail investors but also by corporations, governments, and institutions.

The Maturing Crypto Industry

The broader cryptocurrency ecosystem has matured in tandem with Bitcoin. Blockchain technology is no longer a buzzword—it’s being implemented in supply chains, gaming, healthcare, finance, and even governance systems. Decentralized finance (DeFi) platforms, non-fungible tokens (NFTs), and smart contracts have expanded what digital assets can do.

However, with maturation comes scrutiny. Regulators across the globe are developing frameworks to manage the risks of crypto while encouraging innovation. These frameworks will play a significant role in shaping how Bitcoin and other digital assets are used in the future.

Key Trends Shaping Bitcoin’s Future

1. Institutional Adoption

Institutional involvement in Bitcoin has increased dramatically over the last few years. Companies like MicroStrategy, Tesla, and Square (now Block, Inc.) have held Bitcoin on their balance sheets. Investment firms like BlackRock and Fidelity have launched or applied for Bitcoin ETFs. These developments have contributed to legitimizing Bitcoin as an asset class.

As more institutions seek to hedge against inflation and currency devaluation, Bitcoin could become a standard portfolio asset. The introduction of regulated Bitcoin-based investment products also opens the door for traditional investors to gain exposure without owning the asset directly.

2. Global Regulation and Legal Clarity

The future of Bitcoin is inevitably tied to regulation. Countries are taking varying approaches: some, like El Salvador and the Central African Republic, have embraced Bitcoin as legal tender, while others have imposed strict restrictions.

The key challenge lies in finding a balance. Effective regulation can prevent illicit use and protect consumers, but overly aggressive restrictions risk stifling innovation. The United States, European Union, and major Asian economies are actively working on frameworks that will provide more clarity for investors and developers.

A harmonized regulatory environment could propel Bitcoin into mainstream finance, particularly if central banks and governments embrace it alongside their digital currencies.

3. Layer 2 Solutions and Scalability

Bitcoin has faced criticism over its transaction speed and energy consumption. While the Lightning Network—a layer 2 scaling solution—has shown promise in enabling faster, cheaper transactions, it’s still in the early stages of adoption.

Future enhancements to Bitcoin’s scalability and utility will depend on these layer 2 technologies. If widely adopted, they could make Bitcoin more practical for everyday transactions, boosting its use case beyond a store of value.

Moreover, innovations like Taproot (a recent Bitcoin upgrade) have improved privacy and smart contract capabilities. These developments indicate that Bitcoin is not static—it is evolving.

4. Environmental Impact and the Shift to Renewables

Bitcoin mining consumes significant energy, raising concerns among environmentalists and regulators alike. However, the industry is increasingly shifting toward renewable energy sources. Many mining operations now leverage hydro, solar, and wind power, making Bitcoin mining more sustainable.

In the future, Bitcoin’s sustainability narrative could shift from negative to neutral—or even positive—if mining catalyzes investment in renewable infrastructure. This transformation is essential for wider societal acceptance and long-term survival.

5. Bitcoin as a Geopolitical Tool

In a world of increasing economic uncertainty, Bitcoin offers an alternative financial system that transcends borders. For countries facing sanctions, inflation, or limited access to global banking, Bitcoin can be a lifeline.

There is potential for Bitcoin to play a role in global geopolitics—whether as a hedge against U.S. dollar dominance or as a tool for financial inclusion in underbanked regions. Governments may either embrace this shift or push back through strict control of digital financial infrastructure.

The Broader Crypto Ecosystem: Complementary or Competitive?

While Bitcoin leads the pack, it’s not the only influential crypto asset. Ethereum, Solana, Cardano, and others offer functionalities that Bitcoin lacks, particularly around smart contracts and decentralized applications. Rather than competing directly, these platforms often serve complementary roles.

For instance, Bitcoin is primarily seen as a secure store of value, while Ethereum powers the majority of DeFi and NFT platforms. In the future, we might see more interoperability between blockchains, creating a cohesive digital asset ecosystem where Bitcoin functions as the reserve currency.

What Could Go Wrong?

While the future is promising, there are significant risks to consider:

- Regulatory Overreach: Overly restrictive laws could force innovation into unregulated or offshore markets.

- Technological Stagnation: If Bitcoin fails to evolve alongside faster, more scalable blockchains, it may lose its competitive edge.

- Security Risks: While Bitcoin’s core protocol is considered highly secure, third-party services (like exchanges and wallets) remain vulnerable to hacks.

- Economic Crises: A global recession could lead to risk-off sentiment, pulling investment away from volatile assets like crypto.

- Public Perception: Media narratives and misinformation can shape public opinion rapidly, influencing adoption and price.

Final Thoughts: Bitcoin’s Role in a Digital Future

As we peer into the horizon, Bitcoin’s role in the future of finance, governance, and technology appears more crucial than ever. Its decentralization, fixed supply, and security make it a unique asset in a world increasingly leaning toward digitization and surveillance.

The crypto industry will continue to evolve—with new innovations, setbacks, and regulations—but Bitcoin’s foundational principles will likely anchor it amid the volatility.

Whether you’re a believer, a skeptic, or somewhere in between, one thing is clear: the crypto industry isn’t going away, and Bitcoin will remain at its center—shaping and being shaped by the world around it.

-

Crypto Regulations Worldwide, And What You Need To Know

Regulations regarding crypto industry are constant debate around the world, and have a huge impact on the cryptocurrency market. Mostly crypto law regulations affect people in the country they are from, but in some instances law changes regarding crypto in other countries can impact your crypto holdings. Lets dive deeper into what is the current state with crypto laws world wide, and what we need to pay attention to.

We are going to look into crypto regulations within USA, European Union, China, United Kingdom, India, Canada, Brazil, Australia, Japan and Singapore.

USA

The US market is arguably the most important of all because it is one of the largest crypto markets in the world. The second largest crypto exchange by volume, according to CoinMarketCap, in the world is Coinbase, which is located in the US and has to obey US laws and regulations. Kraken is the 3rd crypto exchange by volume in the world, according to CoinMarketCap, and is also located in the US, and under US crypto laws and regulations. A few other important crypto exchanges located in the US are eToro, Uphold, Binance US, Crypto.com, and Robin Hood.

The US government handed jurisdiction to existing market regulators Commodity Futures Trading Commission (CFTC) and Securities and Exchange Commission (SEC) to further regulate the crypto market within the US. SEC was involved in a lawsuit against Ripple Labs, that was ruled in Ripple’s flavor as of July 2023, declaring its native token XRP sales to institutional investors as a investment contract, while XRP sales to retail investors was not considered investment contract. In recent months SEC has been targeting crypto companies Coinbase and Binance, aiming to clear up their crypto offerings and offer more robust customer protection and security according to their Chairman Gary Gansler.

THE current US government is also planning to look more closely into digital asset exchanges, and try to asses the potential risk involved with decentralized finance (DeFi) and Non Fungible Tokens (NFT’S) sometime in 2023. We can expect more government regulations towards cryptocurrencies in the US in the near future if everything continues to go in the current direction.

European Union

Individual member states have option to regulate cryptocurrencies on their own terms, but as of now cryptocurrencies are legal in most of the EU members, with main difference being the taxes ranging from 0% to 50% depending on the country.

EU 5th and 6th Anti Money Laundering Directives were passed recently, with the main focus on mandatory KYC/CFT obligations and more standardized reporting requirements. In 2022 EU agreed upon implementation of Market in Crypto Asset Regulation (MiCA), which increases consumer protection, brings new licensing requirements and sets up easy to understand crypto industry conduct.

Earlier this year, EU parliament approved licensing requirements for certain crypto service providers, with the intention to have easier access to important information that can stop money laundering and terrorist funding using crypto.

China

The People’s Bank of China (PBOC) has a ban on all crypto exchanges within the country, and sees them as a place where public financing is made possible without approval. Furthermore, China considers cryptocurrencies as property and has placed a ban on Bitcoin mining in May 2021. This ban forced large Bitcoin mining operation in China to shut down or relocate to other legal jurisdictions. In September of 2021, China completely banned all cryptocurrencies and we are to see is this going to stay for good or just for a period of time.

In the meantime China has been working on digital yuan (e-CNY), and in August 2022, the first round of the digital pilot program was tested allowing China Central Bank to settle trades with Honk Kong, UAE and Thailand.

United Kingdom

In the UK cryptocurrencies are considered property (not a legal tender), and investors are still obligated to pay taxes on their crypto gains. The amount of taxation depends on the crypto activity and the personal financial situation.

Crypto exchanges have to register with the UK Financial Conduct Authority (FCA), and have to follow certain standards such as Know Your Client (KYC), combating and financing of terrorism (CFT) and anti-money laundering (AML). Crypto exchanges and custodian wallet providers have an obligation to comply with reporting rules set up by Office of Financial Sanctions Implementation (OFSI), and have to report any suspicious person that is a subject to sanctions or has performed a financial sanctions offense.

India

Crypto laws are not so clear in India, where government did not decided on legalization or ban of cryptocurrencies. However, there is a bill proposed in 2021 that aims to ban all private use of cryptocurrencies in India, but it has not been voted on by this day and it stays up in the air. Currently India enforces 30% taxes on all crypto investments, an 1% tax deduction on crypto trades.

It is safe to say that currently crypto investors in India do not have clear laws to follow, and it is to be seen what is coming next. Indian central bank did launch pilot program for digital rupee in late 2022, and we are yet to see where this will lead in the future to come.

Canada

Canada has advanced crypto regulation in comparison the the rest of the world. All crypto investment firms operating in Canada are required to register with the Financial Transactions and Report Analysis Centre of Canada (FINTRAC). Crypto trading platforms and crypto dealers withing Canada are required to register with regional regulators as set by Canadian Securities Administrators (CSA) and Investment Industry Regulatory Organization of Canada (IIROC).

Canada also became a pioneer in approving Bitcoin exchange traded fund (ETF), available on Toronto Stock Exchange. Cryptocurrencies are treated as commodities from taxation point of view within Canada.

Brazil

Brazilian government passed a law in November 2022, that legalized cryptocurrencies as form of payment throughout the country. This in return skyrocketed the adoption on digital currencies within Brazil. This law does not make cryptocurrencies a legal tender in Brazil but it includes it in the definition of payment method. There is still work to be done regarding this, and the government is still to decide which office will be in charge of monitoring this law when in it is fully approved. Bitcoin is not considered legal tender in Brazil and all the tokens that are considered securities will be under the jurisdiction of Brazilian Securities and Exchange Commission (CVM).

Australia

Crypto exchanges are allowed to operate withing Australia after they register with Australian Transaction Reports and Analysis Center (AUSTRAC) and meet set AML/CTF obligations. Australian Securities and Investments Commission (ASIC) set up regulations regarding Initial Coin Offerings (ICO) in 2019, banning the privacy coin offerings that had options of being anonymous and hiding the money flow on their network.

Australia considers crypto as a legal property, and therefore crypto is a subject to capital gains tax. Australia hinted in 2021 that they are looking into regulating cryptocurrencies by creating licensing framework that will set up rules withing the country.

Japan

Japan has a forward thinking approach towards cryptocurrencies, recognizing them as legal property under Payment Services Act (PSA). The country classifies crypto trading gains as miscellaneous income and taxes it accordingly. All crypto exchanges operating in Japan are obligated to register with a Financial Services Agency (FSA), and follow AML/CFT obligations. All crypto exchanges withing the country are members of Japanese Virtual Currency Exchange Association (JVCEA), that was established in 2020.

Japanese government introduced plans to fight money laundering through crypto exchanges and introduced The Act of Prevention of Transfer of Criminal Proceeds which will be revised to collect customer information, with remittance rules started in May 2023.

Singapore

Singapore classifies cryptocurrencies as property. Long term capital gains in Singapore are not taxed, and many crypto traders move there in order to keep their entire gains. However, companies are not exempted of taxes on their crypto gains, and in this case it is treated as income. All exchanges within the country are regulated and licensed by Monetary Authority of Singapore (MAS)..

Conclusion

Since crypto inception in 2009, there has been ongoing debate about its regulations and legality. We can observe that, as crypto evolves, regulations do as well tryin to keep up. It is an ongoing process, that is a subject to controversy, constant debate, adjustment and efforts to understand the industry as whole while putting an end to fraudulent activities. We as users have to be aware of crypto regulations in our country of residence to stay withing the legal framework and to be able to profit in best way possible.

-

Difference Between Web 2.0, 2.5 and 3.0,And How To Benefit.

Web 2.0 is the present state of the web where users can interface with the online games, but are totally dependent on the developers and centralized servers that run the game. Web 2.5 is the next step in web evolution that is already in use, offers some decentralization mainly through NFTs and crypto wallets, and is getting the users ready to embrace the next step in the evolution, Web 3.0. Web 3.0 offers complete decentralization, improved security and freedom.

Source: EastMojo

Web 2.0

Web 2.0 is what is mostly used today, with websites and games that allow

users to interact with each other and the online content on it. Web 2.0 has its

limitations and downsides, and arguably the biggest one being centralization.

Centralization in this context means the power developers, or institutions have

over the particular video game or website. For example, you are a gamer that

plays Call of Duty or Fortnight, and you are able to trade within the game for

weapons, armor, pets etc. All this trade is typically done online with game-limited,

non crypto currency that is completely controlled by game developers or large

multimedia companies, and it runs on centralized servers. This poses a high

risk for gamers and they are essentially left dependent on the mercy of the

game developers. If game developers decide to change the game up, or implement

new upgrades, previous assets used within the game might become obsolete and

players hard work might be for nothing. The same goes for the dependency on

the centralized servers, which might go offline or fall victim to cyber-attacks

that can shut the game down, and all the hard work players put in again goes

down the drain irreversibly. For all these reasons, and for continuous web

development Web 2.5 was created as a bridge to the upcoming Web 3.0.Web 2.5 – The Bridge

Web 2.5 is, as the name suggests, an upgraded version of Web 2.0. The main

difference between the two is the decentralized control players have over their

in-game assets and their data. The biggest change is the introduction of NFTs

(Non-fungible Tokens), which gives users real control over their in-game assets

and the ability to trade them as they see fit, without outside control. Another

major change is the ability to trade in game-earned assets for Cryptocurrencies

and create real-world value. This was the catapult for play-to-earn concept,

that allows players to earn real money within the game. This led to the

integration of crypto wallets that allow users to store, trade, and track their

in-game earned tokens and cryptocurrencies. Why Web 2.5 is still only a bridge

between Web 2.0 and Web 3.0 is the fact that some centralization is still

actively present. Developers still control the in-game currency value, how

in-game assets work and their value, the effectiveness of the weapons, the

gamer community structure, and essentially the value of all in-game items.

Therefore the shift to Web 3.0 is essential, and it will bring all the benefits

that Web 2.5 and Web 2.0 are lacking.Web 3.0 – The Future

Web 3.0 is a decentralized future that we all have been waiting for. Compared to current Web 2.0 and Web 2.5, Web 3.0 promises to deliver full decentralization to its users, with more security, freedom, and stability. Instead of previously mentioned centralized servers

that host Web 2.0 and Web 2.5 (for the most part), Web 3,0 will host its games

on independent nodes, that run on a network of computers. Being structured in

this way, Web 3.0 is much harder to hack, because hacking cannot affect all the

network at once, but instead only parts of it, while other nodes keep the game

going regardless of the hacked part. This truly creates games that all always

online, and puts user security on a new level.One of the things that are important to note is that Web 3.0 will be designed

for everyone, but not all people will be comfortable using it due to its

complexity. For someone familiar with cryptocurrency and blockchain

technology Web 3.0 will be a great asset and relatively easy to use. On the

other hand for those people who are not familiar with blockchain or the cryptocurrency

world, Web 3.0 can be confusing and they will need to learn the basics to start

with. I am referring to the use of crypto wallets, trading of cryptocurrencies,

using seed phrases, NFTs, and all the other elements that are part of this

world, which will require new users to learn it before they can actively

participate in Web 3.0.On top of this, blockchain can consume a lot of computing power if it is

used extensively, and if too much data is stored on it. This might result in

scalability issues as well as number of transactions that can be processed per

minute.Currently, we can see the pioneers of Web 3.0 such as Decentraland and

Sandbox paving the way, and showing how this development can be used and

implemented. In the end, the blockchain was born with the vision of the future,

and constant innovation and development are in its DNA. Web 3.0 is one of the

biggest milestones on this journey and we can sit back and see what is to come

shortly and how we can benefit from all of it. -

What Do You Need To Know About Ethereum Shapella Upgrade

Ethereum Shapella upgrade took place on April 12th and is arguably one of the most significant upgrades on the Ethereum network in recent times. The name Shapella comes from combining two upgrades that were deployed simultaneously, Shanghai and Capella, and therefore the name Shapella was created.

Since Ethereum’s transition to Proof-of-Stake (PoS) on September 15th, 2022, the Ethereum Shapella upgrade is the most important addition to the network as it brings a major mechanic change, one that was highly anticipated by many, especially network validators that had to stake 32 ETH to be in the position to secure the Beacon Chain.

Prior to The Merge to PoS, Ethereum was running on the Proof-of-Work (PoW) consensus algorithm. Since the plans to transition were in the works for many years, the developers created the so-called Beacon Chain in the meantime.

The Beacon Chain was from the start (and still is) validated by PoS. To keep its integrity, beating able to operate as planned, and carry out smart contracts and transactions it needed validators since miners do not exist on PoS-based blockchains.

The Beacon chain was developed as a PoS, and as such it required validators to stake 32 ETH to secure the network. These validators were able to become part of ETH 2.0 from the beginning. To learn more about ETH 2.0 read this post I wrote some time back What is Ethereum 2.0 And How It Can Change The Industry?

The 32 ETH validators staked were locked in the Beacon Depositor contract, during the developmental stage, and were locked for an undetermined time, allowing validators to earn rewards in ETH and be able to unlock it sometime in the future when The Merge and Shangai update get finalized and integrated into the Ethereum network.

The Shapella Upgrade Improvement Proposals

The Shapella upgrade delivered five Ethereum Improvement Proposals (EIPs):

- EIP-3651: Warm COINBASE

- EIP-3855: PUSH0 instruction

- EIP-3860: Limit and meter initcode

- EIP-4895: Beacon chain push withdrawals as operations

- EIP-6049: Deprecate SELFDESTRUCT

EIP-3651 is in place to lower the gas costs that are associated with the maximum Extractable Value payments when accessing the COINBASE address. This will allow other coins to be used for gas payments if there is an insufficient balance of ETH in the wallet. It is important to note that ETH will always be the preferred gas payment method. Coinbase in this context refers to other currencies that can be used to pay for gas fees, it is not referring to the popular exchange.

EIP-3855’s main upgrades include: reducing contract code size, reducing the risk of contracts (mis)using various instructions as an optimization measure, and reducing the need to use DUP instructions for duplicating zeroes. This in nutshell means reduced gas cost, mainly for developers.

EIP-3860 essentially puts a limit on the size of the “INITICODE”, intending to lower the gas fees. This upgrade is created to ensure that “INITICODE” is fairly charged (most importantly cost is proportional to initcode’s length) to minimize the risks for the future and to have a cost system that is extendable in the future.

EIP-6049 focuses on “SELFDESTRUCT” code depreciation and misuse, with an emphasis on growing costs as time goes by and breaking change due to any possible change in the code.

EIP-4895, many would agree, is the most relevant update deployed to the network. These updates allow validators to partially or fully withdraw their ETH stake and rewards accumulated. Partial withdrawals allow 16 validators per ETH block to take out their rewards, and users can do so every week. These refer to any balance above 32 staked ETH. The more significant are full withdrawals, which allow 1800 validators to fully unstack their ETH each day, which comes to 57,600 ETH per day, on top of the partial withdrawals.

What Is Next For The Price Of ETH?

Given the above information, we can see that some significant changes happened in the Ethereum network, that will, no doubt, have a major impact on the price of ETH. It is important to know that the average price of ETH when stalked was $3,149, which can be a good indicator of what comes next.

In my opinion, these changes will have a positive impact on the ETH price, especially in the long run, because it allows more asset allocation. Given the ETH stalked price of $3,149, it is realistic to expect that validators will not sell at a loss, and will at least wait for the price of ETH to reach $.3,200. I think that validators will not sell at that time either since it is evident that the ETH price will keep growing in the next bull run, and reach an all-time high when the market turns bullish. I predicted in my post What Project Will I Invest In Before Bull Market Starts, that ETH price will get to and possibly surpass $10,000 by the end of 2025. I am confident that the majority of validators share this view as well and will wait for the market top to sell their holdings and get the most out of it.

-

What is Solana (SOL) And How It Can Change The Industry

Solana is an open-source project that works on blockchain technology and provides decentralized finance (DeFi) solutions. Work on Solana started in 2017 but the project itself was launched in March 2020 by the Solana Foundation located in Switzerland. The main focus of Solana is to advance decentralized app (Dapp) creation. Solana is governed by a hybrid consensus model consisting of introduced proof of history (PoH) and fundamental proof of stake (PoS) on the blockchain.

Proof of history consensus protocol developed by one of Solana’s founders Anatoly Yokovenko makes Solana unique and offers higher levels of scalability, which in return increases usability. Due to its unique consensus model, Solana (SOL) offers its users incredibly high transaction speeds, with low gas fees. This benefit of Solana was quickly recognized by private and public sectors, and Solana quickly skyrocketed into crypto orbit. The price of Solana reached an all-time high of $260 on November 6th, 2021 according to Coinmarketcap. Coinmarketcap also reports that the price of Solana was at $0.50 around the time of launch. What that all means is that investors were able to make a whopping 51900% increase on their investment. With all the benefits of Solana mentioned above, the project also became one of two major platforms for Non-Fungible Tokens (NFTs) together with Ethereum. In fact, Solana took away a big chunk of NFT traffic from Ethereum due to its lower transaction costs and great scalability. Many crypto enthusiasts started dubbing Solana the Ethereum “killer”, due to its advantages over the rival, and rapid increase in the number of developers developing on the network. People in the financial world started saying that Solana is on a fast track to becoming the “Visa of Crypto”. Due to all of this positive information surrounding the Solana network, it was not a surprise that SOL relatively quickly broke into the top 10 cryptocurrencies by market cap in 2021.

With all that being said, Solana also had some bad moments, from its glory until today. Despite all the positives and all the hype, Solana faced technical issues by having repeated outrages, which negatively affected its price. In addition to this, the project was accused of favoring venture capitalists over small investors with unfair tokenomics. Due to all these issues price of Solana collapsed with the current bear market, and is now just over $18 at the time of writing, losing over 94% of its ATH value in 2021.

But despite all the issues surrounding Solana, I am a firm believer that this project has a bright future ahead, and that in the next bull run of 2024 and 2025, Solana will come back even stronger and break its all-time high. The network foundation is still there and work is being done to minimize network outrages, and improve scalability even more. Recently Polygon (MATIC ) made a major announcement regarding its likely increase in the network’s capabilities and offerings. The blockchain has added Eclipse as its newest partner to launch new software that enables Solana apps to migrate to Polygon or go multichain. Polygon Sealevel Virtual Machine (SVM) is the name of the software that will play a crucial part in bringing Solana’s Sealevel Virtual Machine to the Polygon ecosystem. SVM on Polygon will expand throughput and add to interoperability for crypto-related businesses, including DeFi, gaming, and more.

The current price tag gives many investors a great entry point and a possible life-changing chance of making big money in 2-3 years. According to predictions NFT market on Solana is going to grow and come even closer to Ethereums, while many other promising projects are being built on the Solana network as well. We cannot look away from the lightning speed and transaction per second capacity Solanda network offers, at a fraction of the cost of its main competitors. Time will tell us how this will play out, but with the support of renewed crypto developers such as Ethereum’s Vitalik Buterin, the future of Solana looks bright and I will be there to capitalize on it.

-

What Project Will I Invest In Before Bull Market Starts

Subscribe to continue reading

Subscribe to get access to the rest of this post and other subscriber-only content.

-

What is Ethereum 2.0 And How It Can Change The Industry?

Key Takeaways

- Ethereum upgrade will enable the network to process 1000’s transactions per second, making it cheaper and more user-friendly.

- Ethereum 2.0 will come with a security upgrade and will add additional security to the network from all forms of cyber-attacks.

- Ethereum’s new upgrade will make the network more ecologically friendly by using less computing power and contributing to the efforts of decreasing carbon footprint.

Source: CYBAVO Why Does Ethereum Need An Upgrade?

Ethereum is one of the two most known cryptocurrencies alongside Bitcoin. Since Ethereum is so widely popular, the number of users keeps growing, which in return can lead to network

congestions that result in slow transaction speeds and high gas fees. Network

congestion is something that experienced Ethereum users had to deal with on

many occasions due to increased network traffic, which usually occurs during

the bull market runs when most crypto enthusiasts become more active within the

crypto space.Ethereum is essentially a platform on which most of the crypto assets are built. This means that the

majority of your favorite crypto projects such as Unisvap, Shiba, KuCoin, Chainlink, Aave, Open Sea, and many others are all running on the Ethereum network, and therefore sharing the network capacity. With all these projects using the Ethereum network it is not surprising that the network gets

congested, since all these projects take a piece of the network speed in order to operate.We should also have in mind that most of the NFT traffic is on the Ethereum network. In 2021 that number was as high as 95% of all NFT traffic in the crypto space, and in 2022 it went down by 15%, mostly due to Solana’s rise in NFT space, to a whopping 80% of all NFT traffic according to an analysis from JP Morgan. This is a clear indication of how highly utilized the Ethereum network is, and it is another piece in the puzzle that makes the Ethereum network congested, leading to high gas fees.

Another important thing to consider regarding gas fees and Ethereum network congestion is the time of the day. During mid-day, and around midnight on the weekends Ethereum gas fees known as Gwei tend to be the lowest due to less traffic on the network. The most expensive times to transact on the Ethereum network are from Monday to Friday, usually from 1am to 5pm UTC, with Friday being the busiest day of them all.

Since the Ethereum network currently can process around 30 transactions per second, it is obvious that it is inevitable for network congestions to occur given all the traffic we discussed earlier. This results in extremely high gas fees that users have to pay in order to get their traction validated by the miners. During the busy times, gas fees on Ethereum can go as high as a few hounded dollars per

transaction.What Will Ethereum Upgrade Bring?

The new Ethereum upgrade is expected to fix all these issues and make the network more user-friendly, by changing the concept of gas fees. The newly updated network is expected to have

different types of compensation paid to miners, which is aimed to be more beneficial to users. The idea is that users will have the opportunity to pay some extra money to get their transactions validated, which essentially means network validators will get tipped for their services. This form of payment definitely favors the users, since tips will be voluntary, and a lot less than the current fees that are enforced on the network. This way network will become more user-friendly and will be accessible to more people around the world, that are not in the situation to pay high gas fees as we see on this version of the network.All this will be possible with the increased network speed which is another important part of the

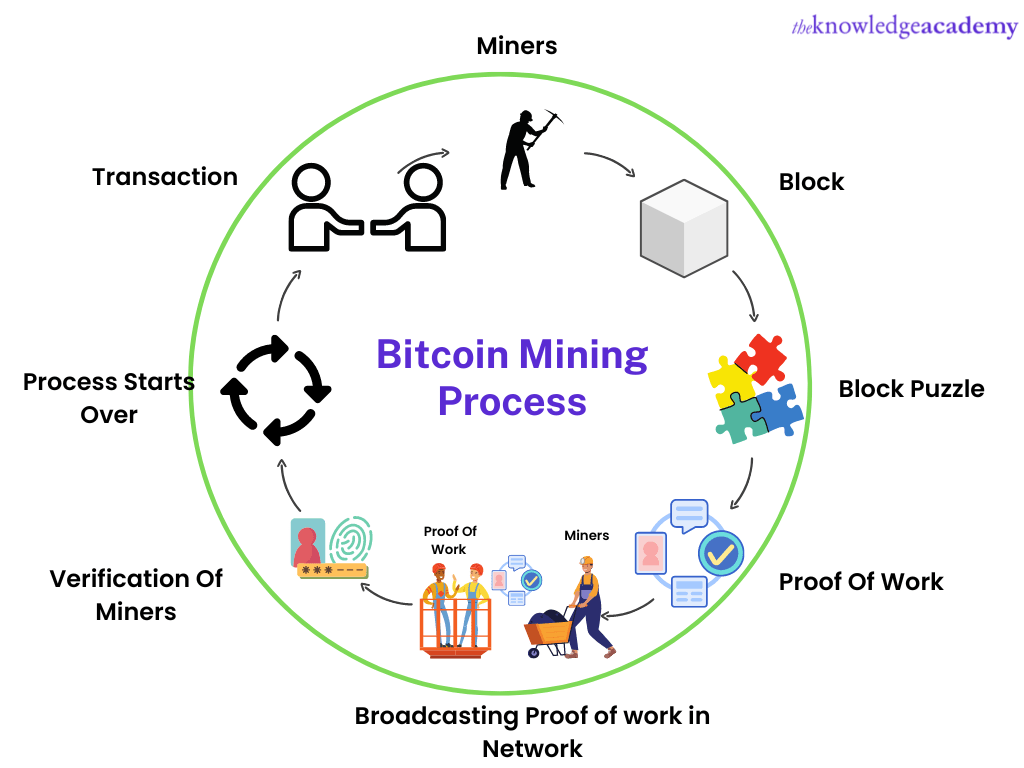

upgrade. The new network speed will allow around 1000 transactions per second, compared to 30 transactions per second at the moment, which is an increase of 97%! This will make the network more efficient as well as affordable, as I mentioned above.Ethereum is currently using proof of work (PoW) consensus to validate blocks, which is a system that

consumes a lot of computing and electrical power. The plan for the new upgrade is to transfer to a more efficient proof of stake (PoS) consensus, which will decrease the energy required to mine blocks. Hardware capacity to mine blocks will be decreased as well, making the network more immune to centralization due to more nodes in the network and that will offer better support for scaling of the network. There are two ways for someone to become a validator on the Ethereum proof of stake network, and that is either by stalking 32 ETH or by stalking less than 32 ETH in the joint pool that is designed for it. Since PoS consensus requires less electricity and computing power, it is more eco-friendly compared to PoW, therefore contributing to the reduction of carbon footprint in the atmosphere.

Source: Coin Central

Conclusion

New upgrades that are being designed for the Ethereum network will have a strong impact on the network usability, speed, and cost, making it more valuable in the process. In my opinion price of ETH will reflect this change in the near future, and whoever holds some ETH will make some good gains by 2025. Most importantly this update will allow more mainstream adoption of cryptocurrencies and allow faster integration into everyday life. Many other cryptocurrencies that run on the Ethereum network will be more accessible to worldwide users due to lower transaction costs. That in return will benefit the crypto industry as a whole and bring it one step closer to wider adoption.

Best,

Crypto Buildup

-

What Factors Influence Crypto Market And How To Be Prepared?

Key Takeaways

- Bitcoin Halving is, many will argue, the most important thing that shapes the movement of the crypto market.

- Government regulations are a powerful tool that has been always influencing both the crypto market and the overall institutional adoption of cryptocurrencies.

- Federal Reserve or Fed, has always had a strong influence on the crypto market trend, mainly by manipulating the borrowing interest rates.

- Mayor global events have always been connected with major market movements, and are extremely important factors to pay close attention to.

Bitcoin Halving Market Influence

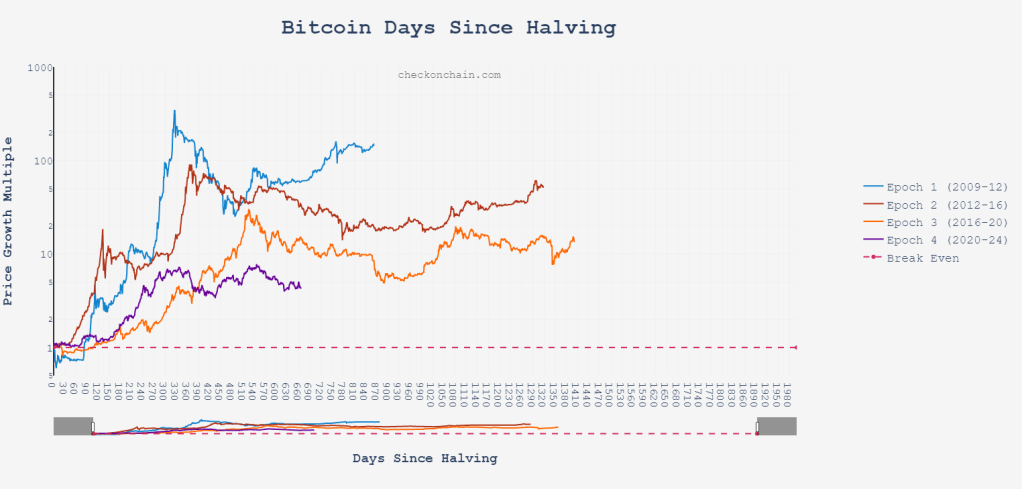

Bitcoin halving has always been tightly correlated to crypto market trends. When we look at the history of Bitcoin halving we can see a reoccurring trend, in which months prior to halving hype around the market increases and more investors start paying attention and investing. Bulls enter the market more aggressively after the halving, resulting in huge price spikes of some crypto assets.

Ethereum Price And Bitcoin Halving Correlation

Let’s look at the biggest altcoin Ethereum, and its price movements post Bitcoin halving. Ether has been through two halving cycles, with us currently being in the second one that started on May 11th of 2020. The first halving that Ethereum was in occurred in 2016, and ETH went up an astonishing 120X by January of 2018, less than two years post halving. In the last halving that occurred in 2020, ETH went up by an impressive 26X by November of 2021, which again was less than two years after the halving took place. From these two examples, we can see a direct correlation between Bitcoin halving and Ethereum price increase, following a similar pattern on both occasions. It is important to note that Bitcoin halving has a similar effect to other crypto assets, which tend to follow similar trends and gain value alongside Bitcoin. The graph below shows Ethereum vs Bitcoin growth in the last two post-halving cycles.

Source: Ecoinometrics/Twitter Government Regulations And Crypto Market

We all know that government regulations can have a huge impact on any industry, and crypto is not an exception. There has always been a lot of speculation surrounding the crypto market, which sometimes can be a good thing, other times not so much. If speculations around the industry are positive, the market tends to react accordingly. Examples of positive speculations can be acceptance of Bitcoin ETFs, crypto law that will put some clarity on the industry, favorable crypto tax law that aims to lower the taxes on crypto gains, and many more. What all these have in common is the fact that they are controlled by the government, and therefore the government has all the power to change, edit or cancel any of these regulations. Positive news and speculations are usually more dominant during bull markets. Since crypto is a relatively new industry, there should be no surprise that this puts a lot of uncertainty and doubt around it.

All this leads to many unfavorable speculations around the crypto industry, which in return can hurt the market and create panic amongst investors. An example of negative speculations can be government looks into increasing taxes on crypto gains, the government will vote on a bill that may ban cryptocurrencies, European Parliament will vote on a bill that aims to stop proof of work (PoW) based assets due to high electricity consumptions and many more. All these aspects are again controlled by the government and can be edited, changed, or canceled at any time. This leaves a lot of room for speculation, and during bear markets, we can see more news like this emerging and spreading additional fear and doubt among investors.

It is important to follow the news and be up to date about laws and regulations that are concerning the crypto industry in general, in order to be better prepared for possible changes that can have a significant impact on the market. By being in the loop we can better anticipate the next market trend, be ready to make our moves toward the right direction, and make the most out of it.

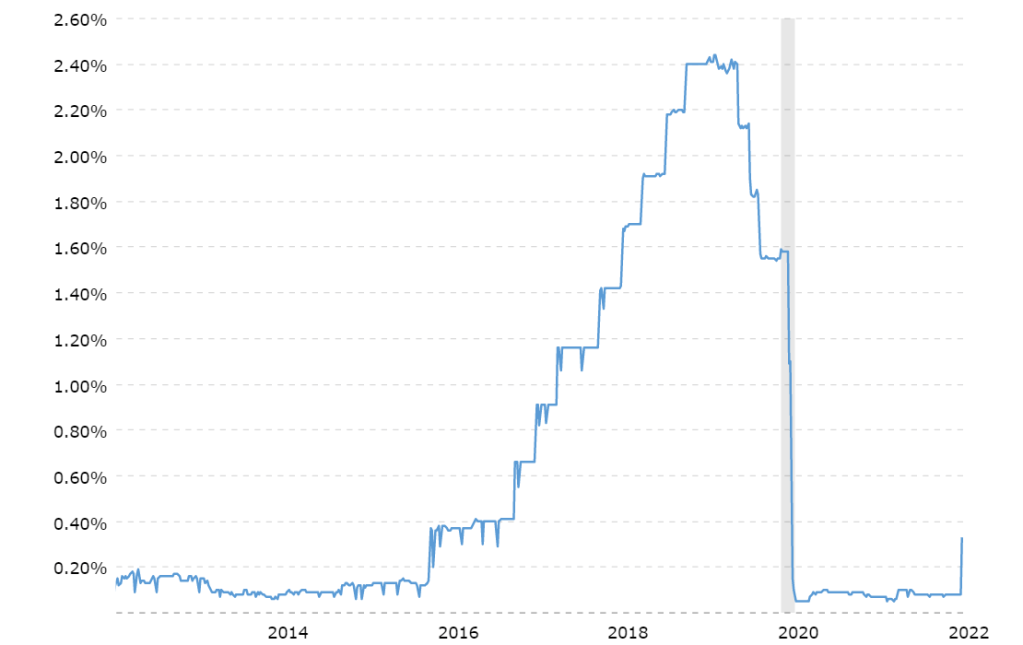

Federal Reserve And Crypto Market Trend

American Federal Reserve or more widely known as FED, has always had a very strong influence on the crypto market trends by manipulating the interest rates on borrowing. If you don’t know what FED is, think of it as a central bank that puts money into the economy by lending it out to borrowers with some interest rate attached to it. When FED decides to increase their interest rates throughout the year less number of borrowers are willing to look for a loan, and therefore less money is being invested in assets such as cryptocurrencies, and more money is historically been pulled out from the markets during those times. We can see a correlation between FED’s increased interest rates and the crypto market downtrend that happened in 2018 when interest rates started increasing above 1% in late 2017 when the crypto market had its peak, and BTC reached $20000 in December. FED’s interest rate increase continued throughout 2018, most of 2019, and reached 2.44%. This was the biggest interest rate increase since 2008, and if we look at the BItcoin chart during the same time we can see a big correction that started around the same time as interest rates reached higher numbers. You can see both charts below. In my opinion, FED’s fiscal policy should be closely monitored because it shapes the market in many ways, and can be a useful tool to help predict the market trend.

FED INTEREST RATES IN THE LAST 10 YEARS – Source: Macrotrends.net

BITCOIN ALL TIME CHART – Source: Coinmarketcap Major Global Events And Crypto Market

Every or almost every industry in the world is affected to some degree or another by major global events that can have positive or negative impacts. The current war in Europe is an example of this, and it affects global markets negatively in different ways. Some industries are experiencing shortages or decrease supplies, which lead to increased prices and lower consumer purchasing power, which is a sign of inflation. There is a lot of speculation surrounding the crypto industry and the current war situation. Many people were and are still wondering is Russia using crypto to bypass financial sanctions imposed on them. If that is the case, should crypto exchanges ban Russian users from their platforms and freeze their assets? This is still being discussed, but some exchanges such as Binance refused those propositions saying that crypto is decentralized and making it centralized beats the whole purpose in the first place. Another more positive crypto story connected to this war is many donations that people are sending in form of cryptocurrencies to the Ukrainian Ministry of Defense, which surpassed the value of $100 million according to many sources.

Another example of a major global event that shook the industries is Covid-19, which was something that was unexpected by most and caught the world by surprise. Many businesses were forced to shut down and never recovered, while others took huge debts to stay in business. Both crypto and the stock market took huge hits and prices went sharply down.

Conclusion

It is important to know the relation between all these factors and the crypto market if we want to be better prepared for sudden market changes. The best way that I see it is by being consistent with Coinmarktcap news, or any other news that you follow as long as they are covering these topics related to the crypto industry. FED always announces rate increases in advance which give investors enough time to prepare and act on it. Bitcoin halving is also an event that is anticipated in advance, therefore, giving us some time to be better prepared for its influence on the market. Government regulations are also something that is known in advance, so we can plan our moves according to the news. Mayor global events are sometimes hard to predict, but in many cases markets do not react right away, giving investors time to decide what is in their best interest. All in all, we can see that all these factors come with a fair warning ahead of the actual event, and by being involved in the news about the industry investors can be better prepared and ultimately make the most out of it.

Best,

Crypto Buildup