Key Takeaways

- Bitcoin Halving is, many will argue, the most important thing that shapes the movement of the crypto market.

- Government regulations are a powerful tool that has been always influencing both the crypto market and the overall institutional adoption of cryptocurrencies.

- Federal Reserve or Fed, has always had a strong influence on the crypto market trend, mainly by manipulating the borrowing interest rates.

- Mayor global events have always been connected with major market movements, and are extremely important factors to pay close attention to.

Bitcoin Halving Market Influence

Bitcoin halving has always been tightly correlated to crypto market trends. When we look at the history of Bitcoin halving we can see a reoccurring trend, in which months prior to halving hype around the market increases and more investors start paying attention and investing. Bulls enter the market more aggressively after the halving, resulting in huge price spikes of some crypto assets.

Ethereum Price And Bitcoin Halving Correlation

Let’s look at the biggest altcoin Ethereum, and its price movements post Bitcoin halving. Ether has been through two halving cycles, with us currently being in the second one that started on May 11th of 2020. The first halving that Ethereum was in occurred in 2016, and ETH went up an astonishing 120X by January of 2018, less than two years post halving. In the last halving that occurred in 2020, ETH went up by an impressive 26X by November of 2021, which again was less than two years after the halving took place. From these two examples, we can see a direct correlation between Bitcoin halving and Ethereum price increase, following a similar pattern on both occasions. It is important to note that Bitcoin halving has a similar effect to other crypto assets, which tend to follow similar trends and gain value alongside Bitcoin. The graph below shows Ethereum vs Bitcoin growth in the last two post-halving cycles.

Government Regulations And Crypto Market

We all know that government regulations can have a huge impact on any industry, and crypto is not an exception. There has always been a lot of speculation surrounding the crypto market, which sometimes can be a good thing, other times not so much. If speculations around the industry are positive, the market tends to react accordingly. Examples of positive speculations can be acceptance of Bitcoin ETFs, crypto law that will put some clarity on the industry, favorable crypto tax law that aims to lower the taxes on crypto gains, and many more. What all these have in common is the fact that they are controlled by the government, and therefore the government has all the power to change, edit or cancel any of these regulations. Positive news and speculations are usually more dominant during bull markets. Since crypto is a relatively new industry, there should be no surprise that this puts a lot of uncertainty and doubt around it.

All this leads to many unfavorable speculations around the crypto industry, which in return can hurt the market and create panic amongst investors. An example of negative speculations can be government looks into increasing taxes on crypto gains, the government will vote on a bill that may ban cryptocurrencies, European Parliament will vote on a bill that aims to stop proof of work (PoW) based assets due to high electricity consumptions and many more. All these aspects are again controlled by the government and can be edited, changed, or canceled at any time. This leaves a lot of room for speculation, and during bear markets, we can see more news like this emerging and spreading additional fear and doubt among investors.

It is important to follow the news and be up to date about laws and regulations that are concerning the crypto industry in general, in order to be better prepared for possible changes that can have a significant impact on the market. By being in the loop we can better anticipate the next market trend, be ready to make our moves toward the right direction, and make the most out of it.

Federal Reserve And Crypto Market Trend

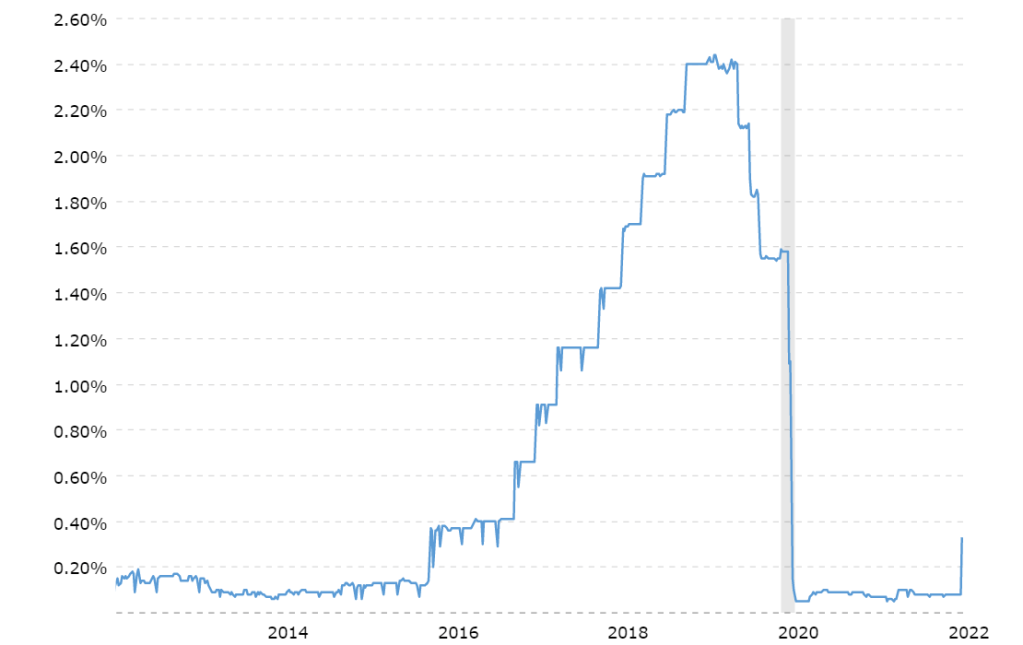

American Federal Reserve or more widely known as FED, has always had a very strong influence on the crypto market trends by manipulating the interest rates on borrowing. If you don’t know what FED is, think of it as a central bank that puts money into the economy by lending it out to borrowers with some interest rate attached to it. When FED decides to increase their interest rates throughout the year less number of borrowers are willing to look for a loan, and therefore less money is being invested in assets such as cryptocurrencies, and more money is historically been pulled out from the markets during those times. We can see a correlation between FED’s increased interest rates and the crypto market downtrend that happened in 2018 when interest rates started increasing above 1% in late 2017 when the crypto market had its peak, and BTC reached $20000 in December. FED’s interest rate increase continued throughout 2018, most of 2019, and reached 2.44%. This was the biggest interest rate increase since 2008, and if we look at the BItcoin chart during the same time we can see a big correction that started around the same time as interest rates reached higher numbers. You can see both charts below. In my opinion, FED’s fiscal policy should be closely monitored because it shapes the market in many ways, and can be a useful tool to help predict the market trend.

Major Global Events And Crypto Market

Every or almost every industry in the world is affected to some degree or another by major global events that can have positive or negative impacts. The current war in Europe is an example of this, and it affects global markets negatively in different ways. Some industries are experiencing shortages or decrease supplies, which lead to increased prices and lower consumer purchasing power, which is a sign of inflation. There is a lot of speculation surrounding the crypto industry and the current war situation. Many people were and are still wondering is Russia using crypto to bypass financial sanctions imposed on them. If that is the case, should crypto exchanges ban Russian users from their platforms and freeze their assets? This is still being discussed, but some exchanges such as Binance refused those propositions saying that crypto is decentralized and making it centralized beats the whole purpose in the first place. Another more positive crypto story connected to this war is many donations that people are sending in form of cryptocurrencies to the Ukrainian Ministry of Defense, which surpassed the value of $100 million according to many sources.

Another example of a major global event that shook the industries is Covid-19, which was something that was unexpected by most and caught the world by surprise. Many businesses were forced to shut down and never recovered, while others took huge debts to stay in business. Both crypto and the stock market took huge hits and prices went sharply down.

Conclusion

It is important to know the relation between all these factors and the crypto market if we want to be better prepared for sudden market changes. The best way that I see it is by being consistent with Coinmarktcap news, or any other news that you follow as long as they are covering these topics related to the crypto industry. FED always announces rate increases in advance which give investors enough time to prepare and act on it. Bitcoin halving is also an event that is anticipated in advance, therefore, giving us some time to be better prepared for its influence on the market. Government regulations are also something that is known in advance, so we can plan our moves according to the news. Mayor global events are sometimes hard to predict, but in many cases markets do not react right away, giving investors time to decide what is in their best interest. All in all, we can see that all these factors come with a fair warning ahead of the actual event, and by being involved in the news about the industry investors can be better prepared and ultimately make the most out of it.

Best,

Crypto Buildup